Last Updated: 5/10/2018

The National Institutes of Health (NIH) uses a modular budget format for some applications rather than requiring a full detailed budget. The modular budget format allows applicants to request funds in $25,000 intervals up to $250,000 in direct costs per year. Even though the modular budget is all that is required for submission to NIH, internally MSU still requires a detailed budget to ensure the project has been properly costed and that Facilities and Administrative (F&A) costs have been calculated correctly. In Kuali Research, users can create their detailed budget within the application and use the “Sync” functionality to automatically generate the modular budget.

*NOTE: Job aid assumes that a detailed budget has already been created

WHO:

- College/ Department Administrators

- Principal Investigators/ Key Personnel

WHEN:

- Preparing an NIH proposal with a Modular Budget

HOW:

Split into the following 3 Sections:

Syncing to the Modular Budget

This is the recommended method for creating your modular budget. Take the following steps:

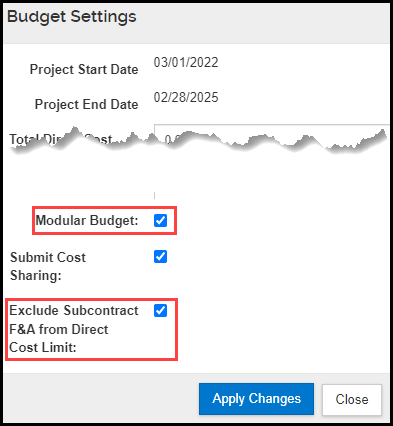

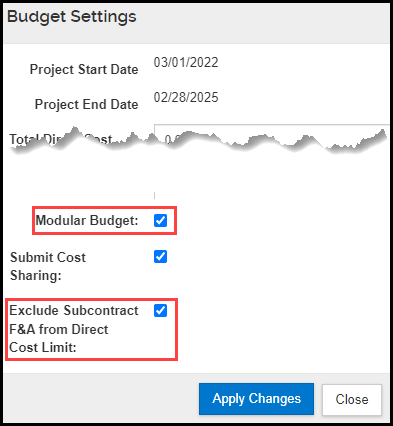

- Click the Budget Settings link along the row at the top of the budget.

- Verify that the checkbox next to Modular Budget is checked.

- If your budget includes a subaward, click the checkbox next to Exclude Subcontract F&A from Direct Cost Limit.

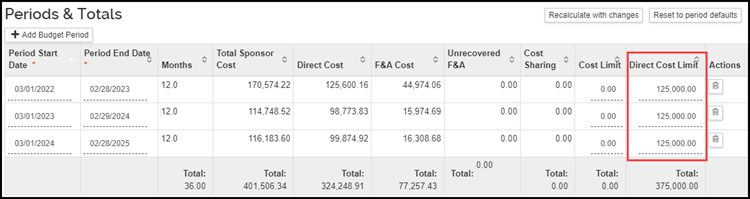

- From the Periods & Totals option, enter the modular amounts in the Direct Cost Limit column. Note: if you have a subaward, do not add the subawardee’s F&A to the modular amount in the Direct Cost Limit fields.

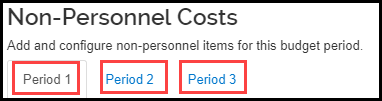

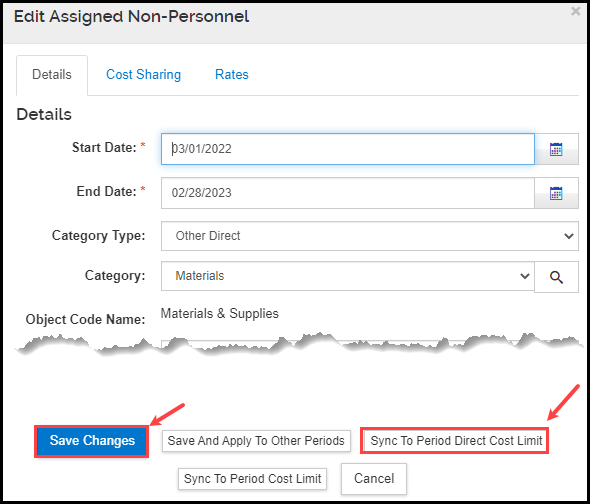

- Sync to the direct cost limits by selecting the Non-Personnel Costs option and taking the following steps:

- Select the appropriate budget Period tab

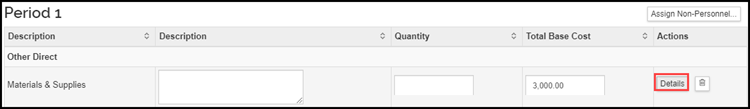

- Click the Details button next to the Non-Personnel budget category you would like to sync to.

- Within the pop-up, click the sync to period direct cost limit button to change the cost for that line item to a dollar amount that will bring the direct costs for that budget period to equal the Direct Cost Limit field.

- Click the Save Changes button.

Note:

- The system will not sync to Personnel Costs; you can only sync to Non-Personnel Costs.

- The system provides the following warning when reducing a line item: “Period direct cost is greater than the direct cost limit for this period. Do you want to reduce this line item cost to make the period direct cost the same as the period direct cost limit?” Click Yes if you would like to proceed with syncing to the direct cost limit.

- Repeat step 3 for each budget period

- Click Save to finalize your selections

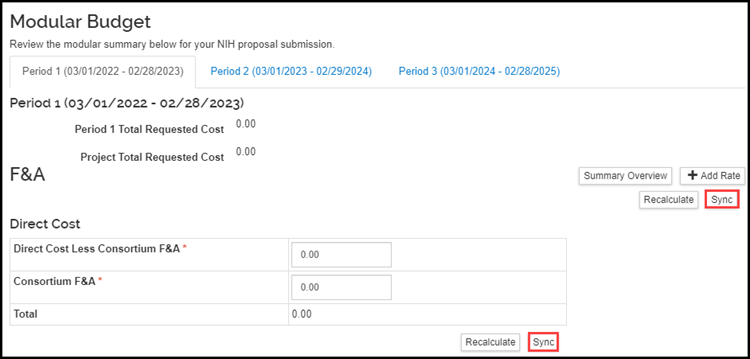

- Click on the Modular option

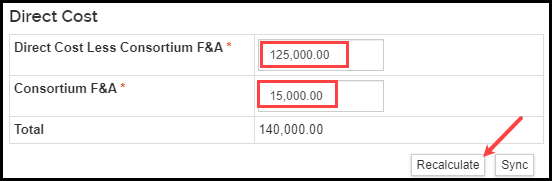

- Click the Sync button to bring in the modular calculations and totals.

Note: the application will always round up to the nearest modular amount based on the total direct cost for the budget period. If you have already built your budget to the modular cost limits you should not experience any changes to the modular amount

- To view one budget period at a time, click the Period tabs along the top.

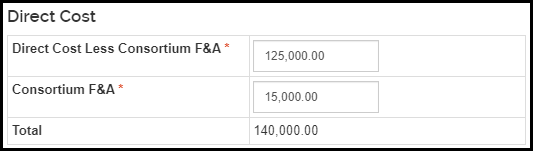

- Verify that the Direct Cost Less Consortium F&A and, if applicable, the Consortium F&A amounts under the Direct Cost sub-heading contains the correct modular amount for the budget period.

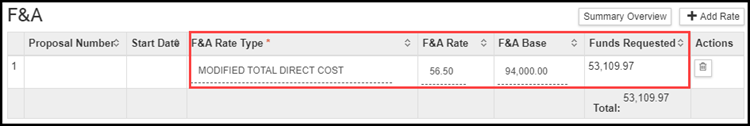

- Verify that the F&A Rate Type, F&A Rate, F&A base and Funds Requested are correct.

- Repeat steps 9 and 10 for each budget period.

- Click Save to update your selections.

Note: Click the Summary Overview button to see totals for the cumulative project period.

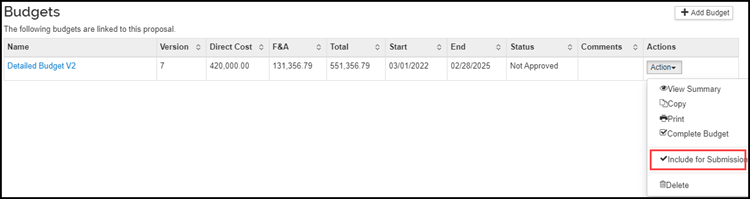

- Return to the proposal and mark the budget final by clicking the drop down under the Action column and selecting Include for Submission. Email your OSP Proposal Team and let them know the budget is ready for review.

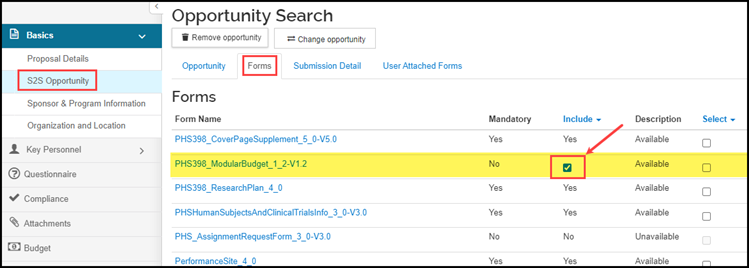

- Navigate to the S2S Opportunity sub-option and click on the Forms tab.

- Check the box to include the PHS398_ModularBudget form with the submission to Grants.gov (and eRA Commons).

Manual Entry of a Modular Budget

We highly recommend following the above steps to create a modular budget, however, there is an option to manually enter a modular budget rather than using the sync feature. Take the following steps:

- Click the Budget Settings link along the row at the top of the budget.

- Verify that the checkbox next to Modular Budget is checked.

- Navigate to the Modular option and select the first period by clicking on the Period 1 tab.

- Under the Direct Cost subheading, enter the module amount for year one in the Direct Cost Less Consortium F&A field. If the budget includes subawards, enter the year one subaward(s) F&A in the Consortium F&A field. Click the Recalculate button and the system will automatically calculate the Total.

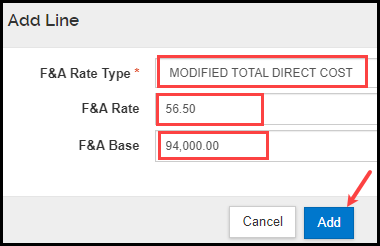

- Under the F&A subheading, click the + Add Rate button.

- In the popup window select the F&A Rate Type, and enter the F&A Rate and F&A Base. Click Add.

- Click Recalculate. The system will calculate and display the Funds Requested amount for F&A.

- Follow steps 2-6 for each budget period, making sure to click Recalculate before moving between periods.

Note: Do NOT click sync on the Modular Budget tab after you’ve manually entered your figures, or the information will be overwritten.

REMINDER: You will still be required to provide OSP with a detailed budget.

How to Enter Subawards in a Modular Budget

In order for the system to calculate a modular budget and exclude the subaward F&A costs from the module amount, we have to tell the system which portion of the subaward budget is for F&A. We also have to tell the system the portion of the subaward costs that are under and over the $25,000 threshhold. We tell the system this information through the use of object codes:

- Subawards <= $25,000

- Subawards > $25,000

- Subawards F&A <= $25,000

- Subawards F&A > $25,000

Rule 1: the object codes “Subaward <= $25,000” and “Subaward F&A <=$25,000” amounts added together will never exceed $25,000 for all years.

Rule 2: the total amounts for object codes “Subaward <= $25,000” and “Subaward > $25,000” equals the total of direct costs for all years.

Rule 3: the total amounts for object codes “Subaward F&A<= $25,000” and “Subaward F&A > $25,000” equals the total F&A budgeted for all years.

- If the total subaward amount for all years is less than or equal to $25,000, only use the object codes “Subaward <= $25,000” and “Subaward F&A <=$25,000” with the applicable amounts in the appropriate years.

- If the total subaward amount for the first year is no more than $25,000, only use the object codes “Subaward <= $25,000” and “Subaward F&A <=$25,000” in the first year applicable amounts.

- If the total subaward amount for the first year is more than $25,000 use the following guidelines:

- First, use the object code “Subaward <= $25,000” with the direct costs amount for no more than $25,000.

- If the direct costs amount is less than $25,000 in the first year, use the F&A amount in the object code “Subaward F&A <=$25,000” so that the object codes “Subaward <= $25,000” and “Subaward F&A <=$25,000” total no more than $25,000 (i.e. Rule 1).

- For any remaining F&A amount in the first year, use the object code “Subaward F&A >$25,000”.

- If the direct costs amount is more than $25,000 in the first year:

- Use $25,000 for object code “Subaward <= $25,000” of direct costs.

- Use object code “Subaward > $25,000” for any remaining amount of direct costs.

- Do not use object code “Subaward F&A <=$25,000”

- Use object code “Subaward F&A >$25,000” for the amount of subaward F&A.

- For any additional years, only use the object codes “Subaward > $25,000” and “Subaward F&A > $25,000” once the object codes “Subaward <= $25,000” and “Subaward F&A <= $25,000” total $25,000 (i.e. Rule 1).

Let’s look at a few examples.

Example 1: The Direct and F&A Costs do not surpass the $25,000 ($25k) threshhold in year one

| |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

| Direct Cost |

15,000 |

20,000 |

23,000 |

25,000 |

26,000 |

| F&A Cost |

7,500 |

10,000 |

11,500 |

12,500 |

13,000 |

| Total |

22,500 |

30,000 |

34,500 |

37,500 |

39,000 |

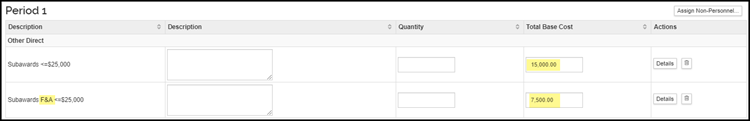

Year 1 object codes would be as follows:

Notice both of the object codes are <= $25,000, however one is for direct costs and the other is for F&A costs.

Notice both of the object codes are <= $25,000, however one is for direct costs and the other is for F&A costs.

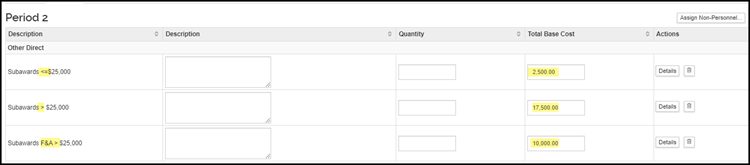

Year 2 object codes would be as follows:

The remaining direct costs that were within the $25k threshhold (i.e. $2,500) are budgeted in the object code for direct costs <= 25k; the remaining direct costs are budgeted in the object code for direct costs that are over $25k ($20,000‐$2,500 = $17,500); and the F&A costs are budgeted in the F&A object code that is over the $25k threshhold.

The remaining direct costs that were within the $25k threshhold (i.e. $2,500) are budgeted in the object code for direct costs <= 25k; the remaining direct costs are budgeted in the object code for direct costs that are over $25k ($20,000‐$2,500 = $17,500); and the F&A costs are budgeted in the F&A object code that is over the $25k threshhold.

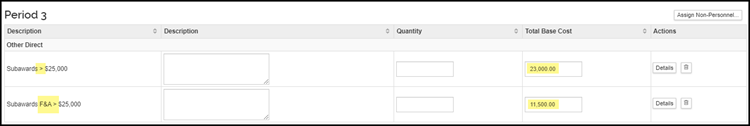

Year 3 object codes would be as follows:

Now that we have exceeded the $25k threshhold, the only object codes that are necessary are the object code for the direct costs over $25k and the object code for F&A over $25k.

Now that we have exceeded the $25k threshhold, the only object codes that are necessary are the object code for the direct costs over $25k and the object code for F&A over $25k.

Years 4 and 5 object codes would be budgeted using the same methodology as year 3.

Example 2: The Direct and F&A Costs surpass the $25,000 threshhold in year 1

| |

Year 1 |

Year 2 |

| Direct Cost |

23,000 |

24,500 |

| F&A Cost |

12,650 |

13,475 |

| Total |

35,650 |

37,975 |

Year 1 object codes would be as follows:

The first $23k in direct costs are budgeted with the object code for direct costs that are <= $25k; the remaining $2,000 within the $25k threshhold are budgeted with the subaward F&A <= object code (i.e. $25,000‐$23,000); the balance in F&A is budgeted with the F&A > $25k object code (i.e. $12,650 – $2,000 = $10,650).

The first $23k in direct costs are budgeted with the object code for direct costs that are <= $25k; the remaining $2,000 within the $25k threshhold are budgeted with the subaward F&A <= object code (i.e. $25,000‐$23,000); the balance in F&A is budgeted with the F&A > $25k object code (i.e. $12,650 – $2,000 = $10,650).

Year 2 object codes would be as follows:

Now that we have exceeded the $25k threshhold, the only object codes that are necessary are the object code for the direct costs over $25k and the object code for F&A over $25k.